Guest Editorial by David Gumbs, James Fletcher & Justin Locke

COVID-19 is crushing tourism-based, import-dependent economies across the Caribbean. Recovery will be slow—but it can also be revolutionary. Guest contributors David Gumbs, James Fletcher and Justin Locke frame for us a vision for how regional governments, with the help of multilateral institutions and global philanthropy, can take this opportunity to fast-track clean energy investment as part of a broader bid to build resilient island nations.

The global economy is on lockdown and the predictions are staggering. In the United States, some economists estimate that GDP could drop 50 percent, at least temporarily, by the end of 2020. It is fair to say that the global economy is—at least during this shutdown period—in free fall.

The coronavirus has caused a complete collapse in the tourism industry and significant contractions in both the agricultural and the distributive trades sectors across the Caribbean.

But the long-term economic implications of the coronavirus are not yet well known. In industrialized countries, economies are diverse and complex. Many economists claim there will be a “v-curve” or at worst a “u-curve” recovery in advanced economies. However, we have yet to see how coronavirus will manifest itself across sectors, let alone the global economy. What is becoming increasingly clear is that the world after COVID-19 will look very different than it did before COVID-19. There will be winners, and there will be losers.

There is one regional economy where the long-term realities of the coronavirus are already clear: The Caribbean. Over the past three decades, nearly every economy in the region transformed to depend on tourism, and today the Caribbean economy is primarily reliant on this single sector. The region is also subject to repeated crises, with 10 Category 5 hurricanes hitting the region in the last 15 years, and five of those occurring in the last three years.

However, in the past these crises were more localized in nature. Economic devastation was limited to a single country or a small number of countries at once. In most cases, especially on larger islands, impacts were felt in only one part of the country or region. Tourism adjusted accordingly. Cruise ships and honeymoons simply moved to the next unaffected island next door. One island’s loss was another island’s gain.

This time no country or group of countries can come to the assistance of another. No skilled workers or professionals can be sent from one island to another to assist with the recovery. The coronavirus has caused a complete collapse in the tourism industry and significant contractions in both the agricultural and the distributive trades sectors across the Caribbean. As a result, the region’s economy is collapsing and will likely not recover for some time.

What Are the Immediate Implications?

In just one day, Saint Lucia lost 13,000 jobs—approximately 7 percent of the total population and 16 percent of the total labor force, which is estimated at 79,700. Some Caribbean electric utilities have reported a 50–60 percent loss in electrical load in March alone, a clear indicator that the economy is depressed.

Caribbean electric utilities have reported a 50–60 percent loss in electrical load in March alone, a clear indicator that the economy is depressed.

On top of that, many people have stopped paying their electricity bills, saving precious dollars for food and survival. Meanwhile, shipments of diesel fuel are waiting to dock. Any utility with an insufficient force majeure clause will be locked into take-or-pay fuel service agreements. They don’t need the fuel because of the loss of electricity demand, and they have nowhere to store it. But fuel suppliers still require payment.

Similar to the 2008 financial crisis, bailouts and stimulus packages can be expected across the globe. The United States recently passed a $2 trillion stimulus package to prop up the economy. In the developing world, including the Caribbean, bailouts and stimulus packages are provided by the International Monetary Fund (IMF) often in partnership with multilateral development banks like the Caribbean Development Bank (CDB), World Bank (WB) and Inter-American Development Bank (IADB).

These financial packages are aimed at providing an injection of liquidity designed to stimulate economic activity. Disbursements are triggered through governance and economic policy compliance mechanisms. When pre-conditioned policy or austerity measures are implemented, a pre-agreed funding amount is disbursed.

Because of the Caribbean’s focus on a single, volatile sector, it is likely to be the first domino to fall in the post-COVID-19 world. When this is all over, the region cannot go back to business as usual. The Caribbean will have to fast-track its journey toward the twin goals that many of its countries embarked on as a result of the impacts of climate change as well as frequent natural disasters: sustainability and resilience.

Investing in clean energy will reduce operating costs and lower the cost of electricity. It will also attract new private investment… This will create new jobs and stimulate economic activity.

As such, any multilateral stimulus should be designed to help the Caribbean transition to a new resilient economy that is anchored in sustainable development. The foundation of the future is clean energy, and on top of this, new diverse industries such as modern agriculture, information technology, financial services and manufacturing can be built. And there is a clear pathway.

Nowhere is the business case clearer or the need for the clean energy transition more urgent than the Caribbean region. This is due to a confluence of three factors, namely: (1) Caribbean countries have some of the highest electricity costs in the world because of their reliance on a centralized, fossil fuel electricity system architecture, (2) they are highly exposed to disruption from natural hazards, some of which are becoming more prevalent and severe due to climate change, and (3) they all have excellent, under-utilized renewable energy resources.

As a result of this unique set of ingredients, the Caribbean region has the potential to be the world’s first renewable energy economy.

Funding an Innovative Energy Transition in the Caribbean

The IMF, WB, IADB and CDB should work with Caribbean leaders to create a dedicated stimulus package aimed at enabling the energy transition as rapidly as possible. Global philanthropy also has a role to play through impact investing designed to catalyze fully commercial private sector investment in clean energy. Philanthropic capital also helps ensure that the most vulnerable do not disproportionately bear the brunt of fatalities and are not left behind during the recovery.

Significant investments have already been made in infrastructure, in training the resident labor force and in the many interrelated industries that depend on tourism. The importance of electricity in the success of the tourism industry and a modern agriculture sector makes a compelling case for investment in the development of a new green, resilient electricity infrastructure. Investing in clean energy will reduce operating costs and lower the cost of electricity for households and business. It will also attract new private investment for tourism, manufacturing, information technology, agro-business and other highly electricity-dependent industries. This will put people to work immediately, create new jobs, and stimulate economic activity. It will also help create the foundation for a new, sustainable, resilient, prosperous, and equitable economy. In the process, clean energy investment in the Caribbean can serve as a guide for future stimulus packages all over the world, as the long-term impacts of COVID-19 manifest.

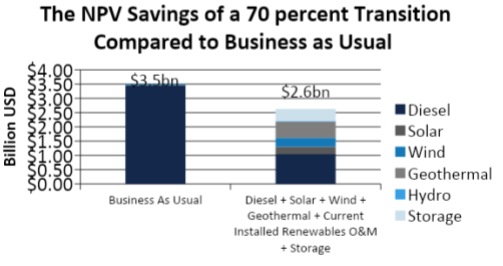

Fuel Cost Savings at 70% RE Penetration

In 2017, Rocky Mountain Institute (RMI) conducted an analysis of the level of investment required to transition the energy sector of the Eastern Caribbean States of Antigua and Barbuda, Dominica, Grenada, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines to 70 percent renewable energy penetration. The above chart shows the potential opportunity for cost saving solely from the reduction of fuel spend (26 percent in 2017). This investment would result in nearly a $1 billion net savings over a 20-year period—leading to lower and more stable rates for customers, and increased energy independence through diversified and local energy sources.

More recently, RMI commissioned a study to understand the costs to transition all 31 countries in the Caribbean to 90 percent clean energy by 2030. The study estimates that it will require around $80 billion in capital investment. To enable this investment, an additional $4 billion in soft costs would be required for project preparation, construction oversight, permitting, interconnection, and commissioning. By realizing this investment, the Caribbean region would save an estimated $9 billion a year in fuel costs. In the process, more than 24 billion liters of diesel fuel imported annually to the Caribbean would be replaced with renewable energy, offsetting 240 million metric tons of CO2 per year. This would translate into valuable savings in foreign exchange for all countries in the region.

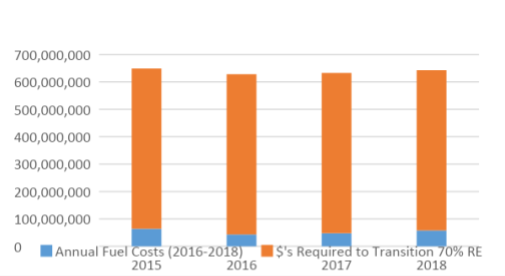

Since 2017, costs of solar photovoltaics (PV) and battery energy storage technology have declined significantly. This further increases the financial opportunity for the Caribbean. Why then have many of these countries not already taken up the challenge to transform their energy economies? The answer is simple: The high upfront capital investment required to make this transformation. The initial investment to transition to clean energy can be as high as 10 times the annual fuel cost for the average Caribbean utility. This is best illustrated in the following chart for the Saint Lucia Electricity Services Ltd. (LUCELEC).

Annual Fuel Costs vs. Upfront RE Transition Costs

The dramatic decline in fuel prices driven by the fall-off in demand from COVID-19 and recent oversupply caused by battles between Saudi Arabia and Russia for market share bring to question if this is the time to make such a significant investment. Given the opportunity for attractive returns on investment under normal circumstances, the answer would be positive. Given the extraordinary circumstances brought on by COVID-19, the response is a very pronounced yes. Here is why.

The per barrel spot price for crude oil has declined as much as 67 percent since December 31, 2019. The significant decline would generally be associated with a corresponding decline in the price of diesel. Yet, diesel prices only declined by roughly 22 percent for the corresponding period. This phenomenon is due to several factors, including timing of shipments and deliveries, refinery processing costs, delivery and shipping costs, marketing and distribution costs, local taxes, sales taxes, and distributor and retail operational costs that make up the price of diesel.

Taxes and fees alone can make up a significant portion of diesel costs. It is estimated that only 70 percent of the price of diesel is affected by crude oil prices. Why is this important? It creates a minimum floor for the decline in diesel prices and distorts the correlation between diesel and crude oil prices. It is likely that the fixed portion of Caribbean prices are as high as 50 percent, given the high transportation costs and duties assessed on imports.

The Case for Low-Cost, Stable Energy Produced by Local Renewables

At current diesel prices, solar PV and other renewable energy technologies remain competitive. Despite the historically low prices for diesel ($1.85 per gallon at time of writing), the average cost of diesel fuel if represented in per kWh terms remains at roughly $0.10. Solar PV, through economies of scale, can generate electricity in the Caribbean context as low as $0.085/kWh. This was best exemplified by the Paradise Park 51.5 Megawatt solar farm developed in Jamaica in 2019.

In a post-COVID world, with increasing global demand and a reduced number of suppliers, there will be upward pressure on oil prices.

There is a direct correlation between oil prices and the high price of energy in the Caribbean. Fuel represents up to 60 percent of utility cost in some countries. It is also widely known that energy prices have a significant effect on the economic growth of Caribbean countries and the region. Volatility in oil prices has also had catastrophic impacts on world economies in prior decades. For example, the economic recession of the mid-1970s was triggered by the Organization of Petroleum Exporting Countries’ (OPEC) oil embargo. The embargo was lifted in early 1974 after the Washington Oil Summit negotiations, but the effects lingered throughout the 1970s. Although not as dramatic, there have been similar examples every 10–15 years since that time. Such volatility inflicts havoc on small Caribbean island economies. The sharp decline in crude oil prices, driven by oversupply and decreasing demand, will be short-lived as demand returns. It is expected that at current lows, many high-cost producers will shut down operations and some may go out of business. In a post-COVID world, with increasing global demand and a reduced number of suppliers, there will be upward pressure on oil prices. As prices increase, utilities and economies stressed and overextended by the pandemic will struggle to remain solvent. It is critical that the Caribbean region, with the aid of multilateral institutions and global philanthropy, take the opportunity to hedge against this risk by transitioning as rapidly as possible to a renewable, resilient future.

The Case for Resilience in the Face of Disaster

Quite apart from fuel price arguments, there is now more data showing that—and how—renewable energy systems are capable of surviving even the most severe category of hurricane. In The Bahamas, RMI worked with Bahamas Power and Light Company (BPL), the Government of The Bahamas and the Government of the United Arab Emirates (UAE) to develop and install a solar parking canopy at the National Stadium in Nassau. It withstood the outer bands of Hurricane Dorian and produced power during and immediately after the storm when the rest of the island lost power. RMI also worked with BPL to build the country’s first Category 5 resilient solar and battery storage microgrid on Ragged Island and is now focusing on designing and delivering sustainable and resilient microgrids for critical facilities in the Abacos, following the destruction wrought by Hurricane Dorian in September 2019.

Resilient microgrids are not just resilient to storms, but—in the current context—also to the severe demand fluctuations brought on by plummeting tourism.

Keeping the lights on during storms is only the first step in the resiliency of these new energy systems. In the current COVID-19 paradigm, these resilient microgrids are flexible and can more easily respond to demand. Independent of the grid and diesel fuel back-up, they can power hospitals, schools, water treatment plants and water distribution, telecommunications, banking systems, police stations and critical agriculture production to maintain food supplies. The benefits are countless, but primarily they reduce lives lost and economic losses by keeping the lights on; they eliminate dependency on diesel fuel contracts and, by bringing power supply and generation into the local economy, lost demand for energy will not incur additional crippling external payments to diesel fuel suppliers. Resilient microgrids are, therefore, not just resilient to storms, but—in the current context—also to the severe demand fluctuations brought on by plummeting tourism. When modern software controls and battery energy storage are added into microgrid systems, renewables produce and store power flexibly, shifting effortlessly from heavy demand scenarios to low demand, where cheaper renewables are stretched even further.

The five Category 5 hurricanes that hit the Caribbean in the last three years present a clear and astronomical risk to the region. For example, to rebuild its electrical grid post Hurricane Irma in 2017, the Anguilla Electricity Company, Ltd. (ANGLEC), spent approximately $8 million. This cost excludes lost revenue from customers who were disconnected from the grid for up to 100 days and does not account for the exponential impact on the tourism industry, productivity, and the larger economy. Prior to 2017, Anguilla averaged a hurricane every two to three years, and a Category 5 storm every 20 years. Colorado State University (CSU), among the United States’ top seasonal hurricane forecasters, has this month forecasted that the 2020 hurricane activity will be approximately 140 percent above the average season. CSU predicts that there will be 16 named tropical storms—four of which are expected to spin into major hurricanes, meaning Category 3, 4 or 5.

Government-owned utilities will need credit enhancement schemes designed to backstop their ability to borrow at low-interest rates to cover the short-term gap in accounts receivable, and direct injections of liquidity to cover operating costs and make grid improvements.

A 2018 study commissioned by ANGLEC showed that the cost to underground the transmission lines in Anguilla would be around $140 million. In normal times, this is not an economical solution because the costs are too high to justify. However, given the increased and immediate risks posed by climate change and the need to put the construction sector to work, investing $140 million to underground the transmission network in Anguilla and every other Caribbean country could bring greater returns or avoided costs in future years. Undergrounding also brings another immediate advantage—jobs. An increase in construction jobs will not only immediately stimulate the construction industry by employing a significant number of people, it will also help revitalize the local economy through the re-circulation of money in local retail markets.

As experienced during the coronavirus shutdown, Caribbean utilities have seen a significant increase in spare capacity (known as ‘reserve margin’ in the utility world) on centralized electrical grids. Electrifying the transportation sector presents an obvious opportunity to provide new load to utilities that can absorb this spare capacity during future economic downturns. In much of the Caribbean, 30–40 percent of fuel imports are consumed in the transportation sector. Given the significant exposure to the volatility of the global oil market, it is critical that this sector be included in the transformation to bring both stability and scale to infrastructure investment. Investments in charging infrastructure can also serve as an economic stimulus for Caribbean countries. This will bolster the demand for electricity (strengthening the local utility), reduce fuel imports (insulating the larger economy), reduce environmentally damaging emissions, and create a new vibrant green economy.

Finally, many electric utilities in the region are government owned. These utilities will need credit enhancement schemes designed to backstop their ability to borrow at low-interest rates to cover the short-term gap in accounts receivable. These utilities will also need direct injections of liquidity to cover operating costs and to make the grid improvements needed to attract independent power producers to invest in renewable generation. The investor-owned utilities will need assurances that accounts receivable will be paid as well as incentives for public-private partnership with host governments to catalyze clean energy investment.

The Path to Energy Independence and Resilience in the Caribbean

It is no secret that Caribbean governments face significant fiscal constraints, and with the impact of COVID-19 that these constraints will become increasingly insurmountable. It only makes sense that the international community and philanthropic sector use this opportunity to inject global public investment initiatives to accelerate project development in the clean energy sector at a pace and scale never seen before. Economic stimulus investments into the clean energy sector therefore present Caribbean countries with an opportunity to:

-

- Bring stability to an otherwise volatile sector

- Create urgently required new jobs

- Reduce electricity costs to attract new industries

- Improve the competitiveness of agro-processing and other manufacturing sectors

- Enhance resiliency

- Shrink the region’s carbon footprint and fast-track commitments to the Paris Climate Agreement

- Decrease leakage of foreign exchange, and

- Diminish dependence on imported fuels.

In order to achieve this, the international community and philanthropy must support Caribbean governments to:

-

- Focus on re-tooling workers to give them skills needed in the clean energy sector, modern agriculture, manufacturing, and information technology

- Boost incentives for electric vehicles (EVs) and design policy measures to unlock EV supply chains as well as investment in EV charging infrastructure

- Forgive overdue electricity bill payments for the poor and local businesses affected by the shutdown

- Backstop electric utility credit and access to low-interest credit while providing liquidity to government-owned utilities to shore up their finances and work with investor-owned utilities to incentivize public-private sector investments—while providing necessary assurances that accounts receivable will be paid in full

- Create clean energy lines of credit designed to backstop power purchase agreements and capital leases to crowd-in private sector investment in renewable generation, and

- Put people to work immediately in the construction sector by undergrounding overhead transmission lines so that they will not be knocked down by the next storm.

Collectively, these actions will help create thousands of jobs, reduce regional emissions and reduce long-term dependence on imported diesel, helping the Caribbean to create a new foundation for a diverse, resilient and sustainable economy. This may be a once in a lifetime opportunity to demonstrate a new vision for the region’s climate future and become an example for the world – transforming its citizens into controllers of their destiny and leaders of the clean energy era.

The Caribbean may be the first economic domino to fall from the coronavirus pandemic. It can also emerge once the crisis is over with a more resilient future through smart utilization of stimulus funding to unlock rapid, intensified investments to help these important islands on the frontlines of climate change make a full transition to become clean energy economies.

About the Contributors

David Gumbs is the former Chief Executive Officer of the Anguilla Electricity Company, Ltd (ANGLEC). David is a graduate of the University of Hartford with a Master of Science in Accounting and Connecticut College with a Bachelor of Science in Economics and Africana Studies. David is a Certified Public Accountant (CPA) with more than twenty years’ operational and managerial experience. Some of David’s former roles include Chief Financial Officer at ANGLEC and Senior Director, Treasury and Financial Analysis at Sodexo, Inc. Under David’s leadership, ANGLEC embraced renewable energy technologies and achieved one of the region’s highest penetration levels in 2016. He successfully negotiated several solar PV and waste-to-energy power purchase agreements for the integration of alternative energy sources into ANGLEC’s generation portfolio. David implemented an aggressive public relations and marketing strategy that strengthened the company’s brand and customer satisfaction scores and improved the company’s performance. He brought efficiencies and cost savings to the organization by incorporating industry-leading solutions such as advanced metering, grid automation, work order automation, and vehicle fleet management into ANGLEC’s operations. Recognizing the Company’s exposure to severe hurricanes, David launched the Company’s first aggressive undergrounding initiative in 2018. Most notably, David led the historic Hurricane Irma recovery efforts restoring the grid to 100 percent in 100 days. Hurricane Irma devastated the island—destroying over 60 percent of its infrastructure. Under David’s leadership and in collaboration with colleagues throughout the region and various partners, including CARILEC, the UK Government, and the Government of Anguilla, the island’s grid was restored in record time—earning him much recognition.

James Fletcher is a former Minister for Public Service, Information, Broadcasting, Sustainable Development, Energy, Science, and Technology in Saint Lucia. He served in that position from December 2011 to June 2016. During his tenure, James led Saint Lucia on an aggressive path toward the modernization of the energy sector with a strong push toward the use of renewable energy. He has been very active in international climate change negotiations. He played a leading role in the Caribbean’s “1.5 to Stay Alive” climate change campaign. During the COP21 negotiations on the Paris Agreement in 2015, he was a member of a small group of 14 ministers from various countries around the world who were selected to assist the COP President in achieving consensus on the more contentious elements of the agreement. Prior to his tenure as a Cabinet Minister, he served as the Director of Social and Sustainable Development at the Secretariat of the Organisation of Eastern Caribbean States, the Cabinet Secretary in the Government of Saint Lucia, and the Permanent Secretary in the Ministry of Agriculture, Forestry, and Fisheries. James Fletcher currently manages his own company, SOLORICON, which provides consulting services in sustainable energy, climate change, water policy, public policy, and agriculture. In 2017, he wrote and published a book entitled Governing in a Small Caribbean Island State. He also authored the Regional Strategic Action Plan for Governance and Building Climate Resilience in the Water Sector in the Caribbean. He coproduces and hosts a weekly television program called PSI—People Solutions Ideas. Dr. Fletcher holds an Honours Bachelor of Science degree in Biochemistry from the University of Ottawa, Canada, and a Doctor of Philosophy degree in Crop Physiology from the University of Cambridge, England.

Justin Locke is a Senior Director at Rocky Mountain Institute (RMI). He co-leads RMI’s Empowering Clean Economies Program and is the senior lead for the Islands Energy Program (https://rmi.org/our-work/global-energy-transitions/islands-energy-program/). Justin also is responsible for international strategic partnerships and resource mobilization with the multi-lateral and bilateral community at RMI. Justin previously held the position of Infrastructure (Disaster Risk Management) Specialist at the World Bank where he managed the Caribbean adaptation and infrastructure portfolio. Before his tenure at the World Bank, Justin worked for the United Nations Development Program (UNDP) in the Pacific Region holding the role of Development Specialist at the UNDP Regional Pacific Center based in Fiji, which provides technical assistance to over 14 Pacific island countries. He also held the position of Community and Recovery Specialist for the UNDP Multi-Country Office based in Samoa where he managed the Polynesian subregion portfolio. He holds a master’s degree in Public Administration in International Management from the Monterey Institute of International Studies in Monterey, California and a bachelor’s degree from the University of California, Davis.