By: Paola Carvajal, Javier García, Carlos Sucre and Christiaan Gischler, IDB

The global hydrocarbon industry has been a long-time pillar of energy systems supplying in 2018 around 54% of global primary energy. This supply comes at a high cost in terms of carbon emissions as it accounted for 56% of the planet’s carbon dioxide emissions in that same year[1]. This dichotomy – a pillar of energy supply but a key agent behind climate change – yields an essential challenge to the industry. Today, the political will is to promote actions that mitigate climate change, transition the energy sector to clean energy sources, and raise multifaceted questions about the role of hydrocarbons in promoting sustainable development. What is the future for oil and gas demand? How can governments and industry leverage existing assets and infrastructure to accelerate the low carbon transition beyond oil and gas? What are the options to diversify towards cleaner energy products?

The hydrocarbon sector has a unique opportunity to reroute, diversify and embrace the Paris Accord Targets

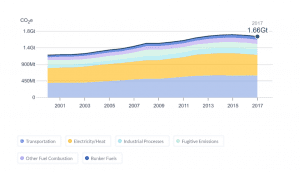

For decades, Latin America and the Caribbean (LAC) has served as an important supplier to the global oil and gas market, stemming from vast reserves (19% of the world’s oil and 4% of the world’s gas are found in LAC) that allow it to produce 4% and 5% concurrently of oil and gas global supplies. While this has made the industry an important source of government revenue, technology adoption, and employment throughout LAC[2], it also contributed 1.66 Gt of CO2e (Figure 1) in carbon emissions from fossil fuel consumption, or 52% of the total carbon emissions in 2017.

Figure 1 | Latin American GHG emissions from key fossil fuel users 2000 – 2017

Source: CAIT. Climatewatchdata.org

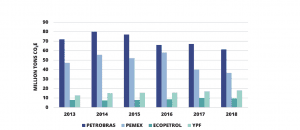

Figure 2 | Annual CO2 emissions from Latin American NOCs

Source: The Dialogue & IDB. “Latin American State Oil Companies and Climate Change”. Petrobras Sustainability Report (2018, 2016), Pemex Sustainability Report (2018), Ecopetrol Integrated Sustainable Management Report (2018, 2016), YPF Sustainability Report (2018, 2017, 2015)

Most Latin American national oil companies (NOCs) have focused their climate change-related actions on energy efficiency and mitigating the routine flaring of methane. This has been largely motivated by cost savings and increasing regulatory restrictions[3]. In the last five years, companies such as Petrobras and Pemex reduced carbon emissions by approximately 20 Mton CO2e (Figure 2) by focusing on mitigating Scope 1 emissions from upstream operations through gas flaring control and energy efficiency programs. While these actions had a positive impact, the results show that NOCs are still unable to chart a net-zero emissions path. However, the development of new technologies, as described below, brings new opportunities for the oil and gas sector that will help NOCs be more proactive and effective, not only in bringing down emissions but also in embracing zero-carbon fuels, as described below:

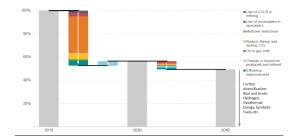

- Methane emission control. Methane (CH4) emissions have an up to thirty-six times higher global warming impact than CO2[4] Methane emission control is one of the critical steps in the decarbonization of the sector. In 2020, the International Energy Agency (IEA) estimated that global oil and gas operations emitted 72 Mt of methane, mostly from natural gas upstream operations and processing facilities. This is equivalent to the total emissions of Europe & Central Asia combined[5]. Decarbonization efforts require a strong commitment to reduce methane venting and leaking. The most cost-effective opportunities to capture methane emissions are the installation of devices such as vapor recovery units, compressor seals, and blowdown capture. As shown in Figure 3, a huge greenhouse gas (GHG) emission reduction (+30%) by 2030 in oil and gas operations could be achieved through methane emission prevention.

Figure 3 | Changes in the average global scope 1 and 2 emissions intensity of oil and natural gas production in the Sustainable Development Scenario, 2018-2040 by the IEA

Source: Adapted by the authors from IEA (2020), The Oil and Gas Industry in Energy Transitions

- Geothermal energy from oil and gas wells. Large hydrocarbon producers in LAC region have thousands of drilled wells onshore where the production of oil or gas is uneconomic. While most of these wells are abandoned, confined, or used for water management or other operational needs, many are still capable of producing water and heat in quantities and temperatures sufficient to be exploited as geothermal energy, either for electricity generation (if temperatures are above 150C) or for direct application as a heat exchanger using the hot fluids. For example, the oil and gas industry in Colombia is developing pilot projects to demonstrate the technical and economic feasibility of producing geothermal energy in the Llanos Orientales basin by leveraging wells with bottom-hole temperatures between 70 and 80oC, large levels of water production, and easy access to above-ground infrastructure. The development of geothermal energy from these wells could contribute to a reduction of GHG emissions not only by integrating renewables as a source of energy into the operations of the oil and gas industry but also by boosting the diversification into clean energy products for local markets such as green power and heat. Moreover, the oil and gas sector could leverage their long-lasting experience in geosciences, drilling operations and techniques (directional and horizontal drilling), long term investments approach and strong financing backing to pivot towards geothermal power, as all of the latter is required to boost geothermal potential both in existing oil and gas concessions and even in pure geothermal areas.

The development of geothermal energy from these wells could contribute to a reduction of GHG emissions not only by integrating renewables as a source of energy into the operations of the oil and gas industry but also by boosting the diversification into clean energy products for local markets such as green power and heat.

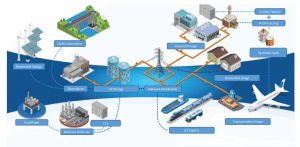

- Blue and green hydrogen production and integration. The use of hydrogen can be one of the key technologies for GHG emissions abatement in hard-to-electrify sectors, such as heavy-industry (cement, steel) or long-range freight and passenger transportation by air and sea. Hydrogen can be classified as blue or green. While the former is sourced from natural gas where its carbon emissions are captured, utilized and/or stored (CCUS), the latter is sourced from electrolysis processes using renewable sources like solar, wind, or even geothermal power. The hydrocarbon industry could play a critical role in the development of blue and green hydrogen by leveraging its existing know-how, its infrastructure for the production, storage, transportation, and integration of natural gas and other gases, and its experience in connecting global demand and supply. Blue and green hydrogen will require the development of efficient CCUS[6] technologies to capture emissions from regular (grey – sourced from natural gas) hydrogen production. According to IEA, 75% of the CO2 captured today in large-scale facilities is from oil and gas operations, and the industry accounts for more than one-third of overall spending on CCUS projects. Similarly, the petrochemical industry could be a key player in diversifying towards cleaner products such as green ammonia or methanol for multi-sector uses. In LAC, countries such as Trinidad & Tobago, Chile, Uruguay and Colombia are currently defining national hydrogen strategies to leverage existing oil and gas sector infrastructure towards the development of clean energy sources.

Figure 4 | Green and blue hydrogen value chain

Source: Adapted by the authors from Hinicio (2020)

- Synthetic fuels production. Synthetic low-carbon fuels could be produced using CO2 captured or sequestered and low-carbon hydrogen, among other combinations (Figure 4). Long-distance transport (mainly aviation) and heavy industry are among the hardest sectors for emissions abatement or electrification and key customers of refined fuels. According to IEA, synthetic fuels are expected to supply 75% of the aviation fuel demand by 2070 under the Sustainable Development Scenario reducing 55% to 80% GHG emissions. Hydrocarbon producers could accelerate the implementation of carbon-neutral fuels in the short-term blending low carbon fuels with the regular ones and, in the long term, integrating blue or green hydrogen, ammonia, methanol and biofuels in the portfolio of clean energy products.

- Reforestation, other renewables and offsets: Oil and gas (O&G) concessions are often located in areas that are suited for reforestation and/or conservation of existing forests, which in both cases may be used as a natural sink of CO2 These concessions may extend for thousands of square miles, therefore utilizing these areas for renewable energy generation with solar and wind from this surface, while extracting fluids and gas from the subsoil. Investing in reforestation in other degraded lands or protected areas as a way to offset emissions is also a viable way to neutralize emissions. Also, forestry activities are subject, in countries such as the European Union, to access financial benefits from emission trading systems as recognized offset protocols.

In summary, the O&G sector has the unique opportunity to undertake new technologies like geothermal power to produce renewable energy, leverage current assets, develop and adopt blue and green hydrogen to gradually replace natural gas, invest not only in synthetic zero-carbon fuels but also in reforestation, other renewables and offsets. This in turn, will help an O&G producer diversify to a clean energy company. International oil and gas companies like Spain’s Repsol are leading the development of infrastructure to produce net-zero carbon synthetic fuels, using green hydrogen and captured CO2. Also, Repsol is investing in other renewables (solar, wind and bioenergy) and plans to offset CO2 emissions through reforestation projects. Similarly, BP announced in 2020 its commitment to cut 40% of oil and gas production by 2030 adopting a strong diversification strategy and Norway’s Equinor is planning to integrate 4-6 GW of green power generation capacity by 2026 and 12-16 GW by 2035.

A unique opportunity for NOCs in LAC

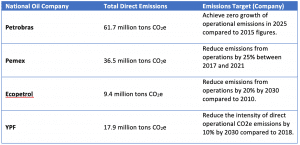

While the major O&G producers continue to diversify towards cleaner fuels and net-zero emissions, it is important to note that NOCs in the have already defined targets to reduce GHG emissions (Figure 5). However, sooner rather than later, they need to speed up the mitigation and diversification efforts to play a critical role in the decarbonization of their national economies. NOCs are the primary fossil fuel energy suppliers in their home countries therefore significant GHG emissions are generated by upstream and downstream operations they control. The opportunity for the NOCs is not necessarily to react to the trend of the larger O&G multinationals, but instead, to be prepared to take a proactive vision towards adopting new technologies, leveraging national infrastructure and resources to diversify into clean energy providers.

Figure 5 | Largest LAC NOCs emissions and targets

Source: The Dialogue & IDB. “Latin American State Oil Companies and Climate Change”. Petrobras Sustainability Report (2018, 2016), Pemex Sustainability Report (2018), Ecopetrol Integrated Sustainable Management Report (2018, 2016), YPF Sustainability Report (2018, 2017, 2015)

The IDB is working jointly with some governments and NOCs to speed up technology adoption to GHG emissions abatement and diversification strategies towards cleaner energy products. By addressing key climate change drivers, there are several benefits for NOCs: (i) optimizing non-renewable resources such as methane emissions for productive uses; (ii) reducing carbon footprints of operations and contributing to national decarbonization efforts; and (iii) hence accelerating the energy transition through sustainable business models and cleaner fuels generation. For a real change in the NOCs, additional support and influence will be needed from national and international investors, governments, technology developers, and local stakeholders. Also, multilateral and climate funds will need to leave their bias at the door and support NOCs to generate the desired change. With these elements in place, the LAC region could gradually reduce its O&G production and eventually replace it with clean and diversified fuels.

The 1st Hydrogen Congress for Latin America & the Caribbean (H2LAC 2021) will gather regional policy-makers and global industry leaders to address the pivotal questions at the most significant gathering of the nascent hydrogen market in the region to date. Co-hosted by the Inter-American Development Bank alongside Strategic Partner Hinicio, join us for a full two day virtual conference (April 14-15) followed by a virtual Policy-Maker Roundtable (April 22).

[1] International Energy Agency. 2020

[2] BP statistical Review of World Energy 2020.

[3] Lisa Viscidi, Sarah Phillips, Paola Carvajal, Carlos Sucre. Latin American State Oil Companies and Climate Change: Decarbonization Strategies and Role in the Energy Transition. June 2020.

[4] United States Environmental Protection Agency, 2020,

https://www.epa.gov/ghgemissions/understanding-global-warming-potentials

[5] Comparison based on World Bank CO2 Emissions Data.

[6] Carbon capture, utilization and storage (CCUS)